The telecommunications sector grew 3.4 percent during the fourth quarter of 2013 (Press Release 10/2014)

The telecommunications sector grew 3.4 percent during the fourth quarter of 2013

- The broadband mobile connections increased by 46.6 percent, with respect to the same period in 2012, and came to a total of 16.56 million

- Incoming international long distance registered an increase of 27.6 percent, with respect to the same period in 2012

- Mobile telephony services presented an increase of 393 thousand subscriptions in the quarter, with which the base reached 103.6 million

- The service of restricted television reached a total of 14.7 million subscriptions, impelled mainly by the growth of 15.9 and 11.7 percent in the cable and satellite segments, with respect to the same period in 2012

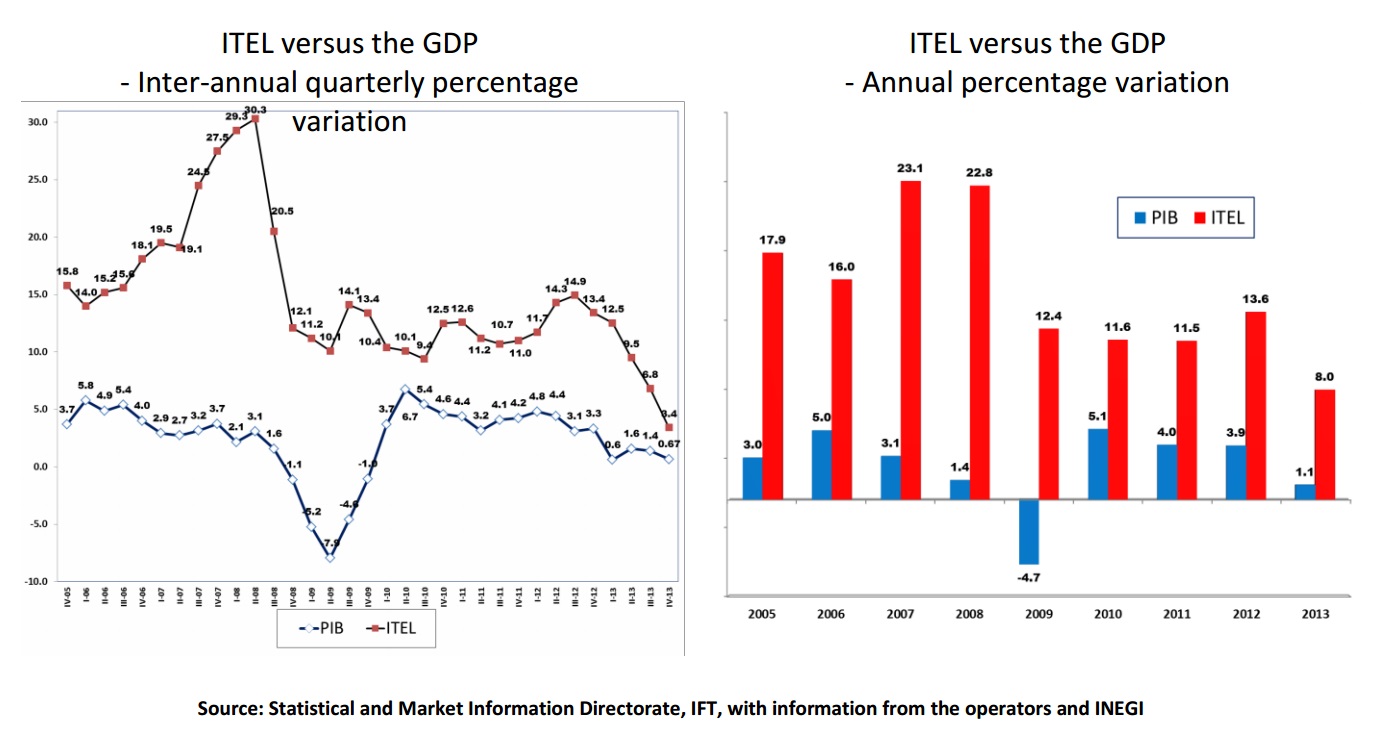

During the fourth quarter of 2013, the Telecommunications Sector Production Volume Index (Índice de Producción del Sector Telecomunicaciones, ITEL)[1], which measures the behavior of the variations of the main variables of production of the telecommunications sector in the country, registered a growth of 3.4 percent in relation to the same quarter in 2012, figure superior to the growth of the Gross Domestic Product (0.7 percent) and which represents almost five times more than the economy as a whole, with which telecommunications continue to consolidate as one of the sectors that help to the growth of the country.

This way, the sector grew in annual terms to an average rate of 8 percent, in relation to the same period in 2012.

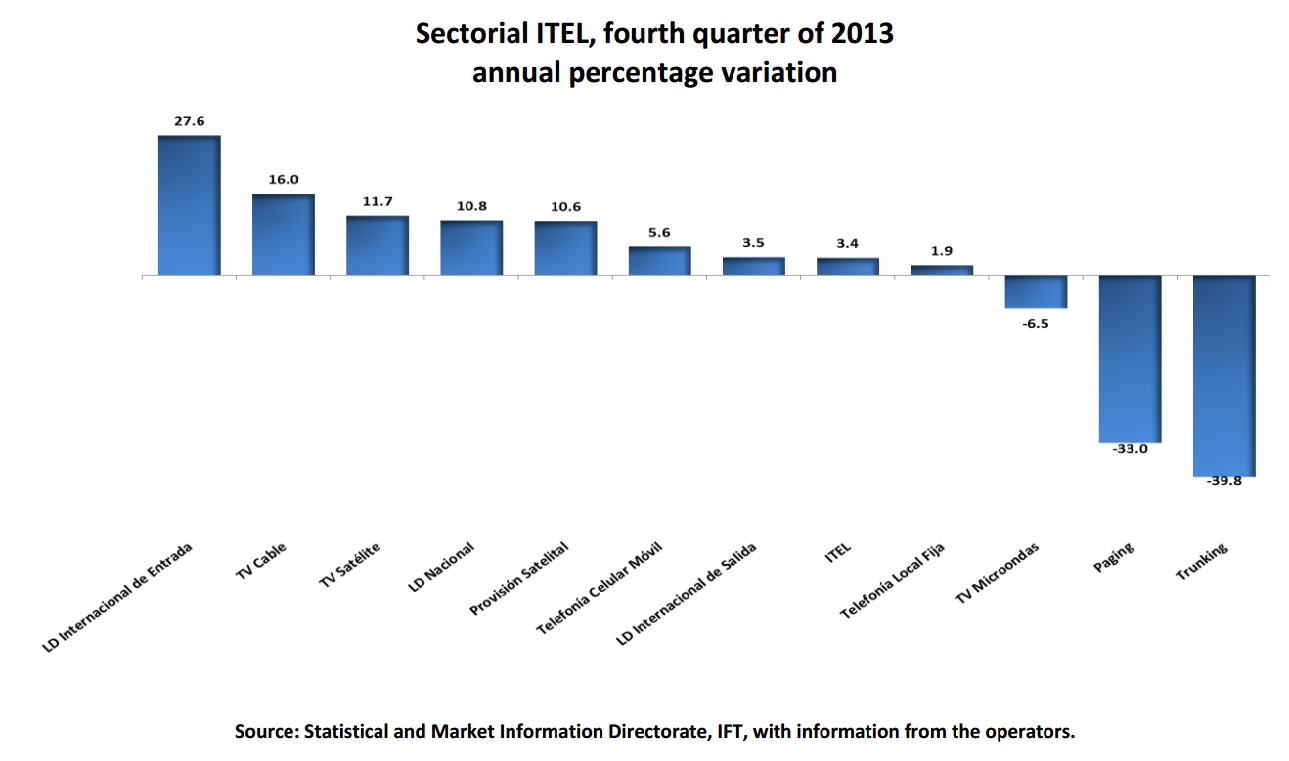

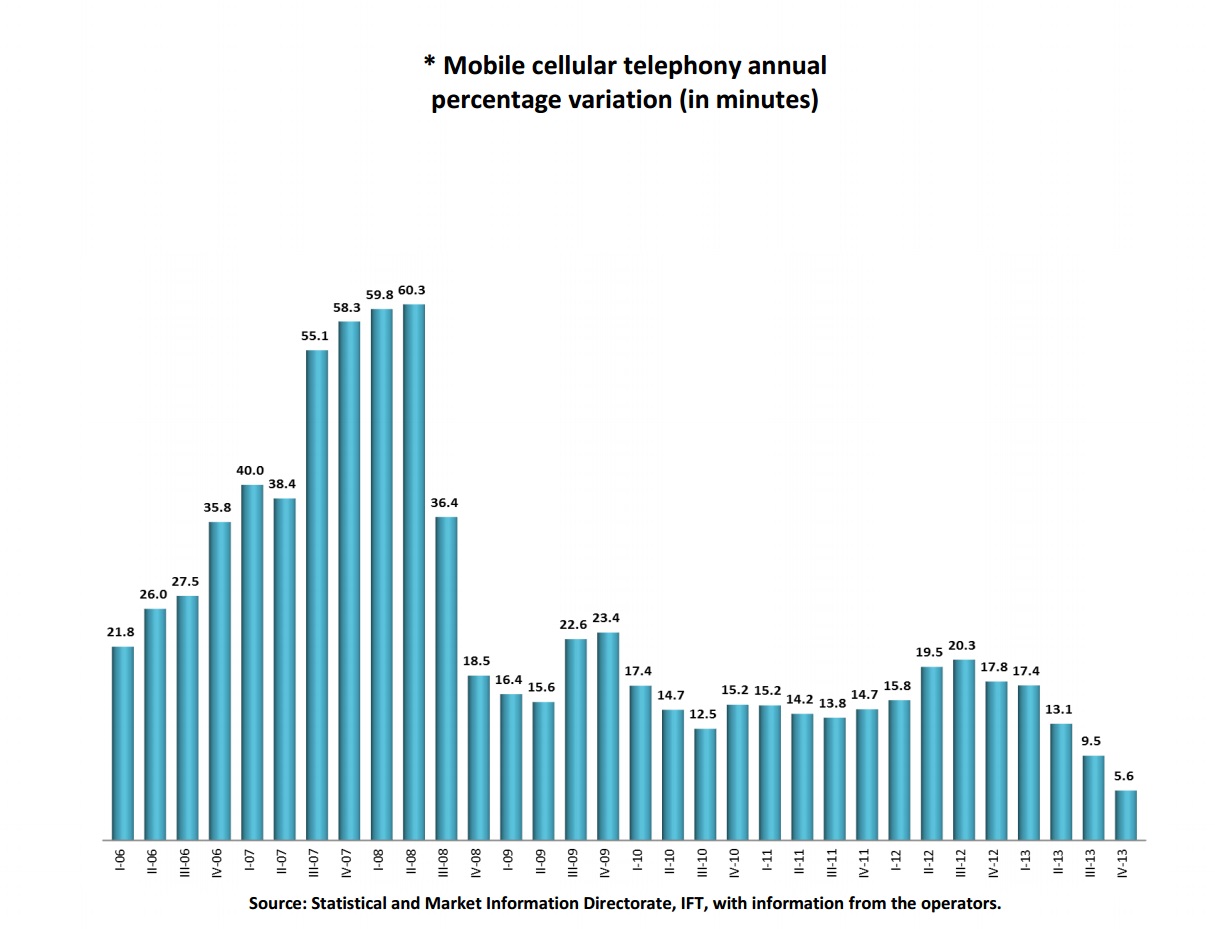

According to ITEL results, the services with better performance in the quarter were: incoming international long distance, registering a growth of 27.6 percent; cable television, with an increase of 15.9 percent; television via satellite, with an increase of 11.7 percent; provision of satellite capacity, with an equal adjustment to the previous quarter of 10.6 percent and mobile cellular telephony, with an advance of 5.6 percent, all measured year-on-year quarterly rates.

In recent years, new technologies offer a great diversity of services, every time more accessible for telecommunications users, replacing the existing services; derivative of this, operators are adopting new strategies to gain more market, also, the users have been specialized more and more in the knowledge and operation of the technologies causing a rising increase in their demand.

Restricted television

The service of restricted television, in its modalities, television via satellite, cable television and television by microwave, grew 13.4 percent during the fourth quarter of 2013, with respect to the same period in 2012.

The service of television via satellite or DTH registered a growth of 11.7 percent in the period, which, although significant, is the lowest registered since the second quarter of 2009. This modality totalized in 7.8 million subscriptions in the last quarter of the year, consolidating itself as the main technology for paid television.

Television by cable observed a greater growth in the quarter, with a rate of 15.9 percent, and concluded the quarter with 6.8 million subscriptions, which represent 46.3 percent of the total of restricted television users.

The number of subscriptions of television via microwave (Multichannel Multipoint Distribution Service, MMDS) services maintains its negative trend, falling by 11.5 percent at an annual rate in the last quarter of 2013 with respect to the same quarter in 2012. At the end of the period, this service had over 134 thousand subscriptions.

Mobile telephony

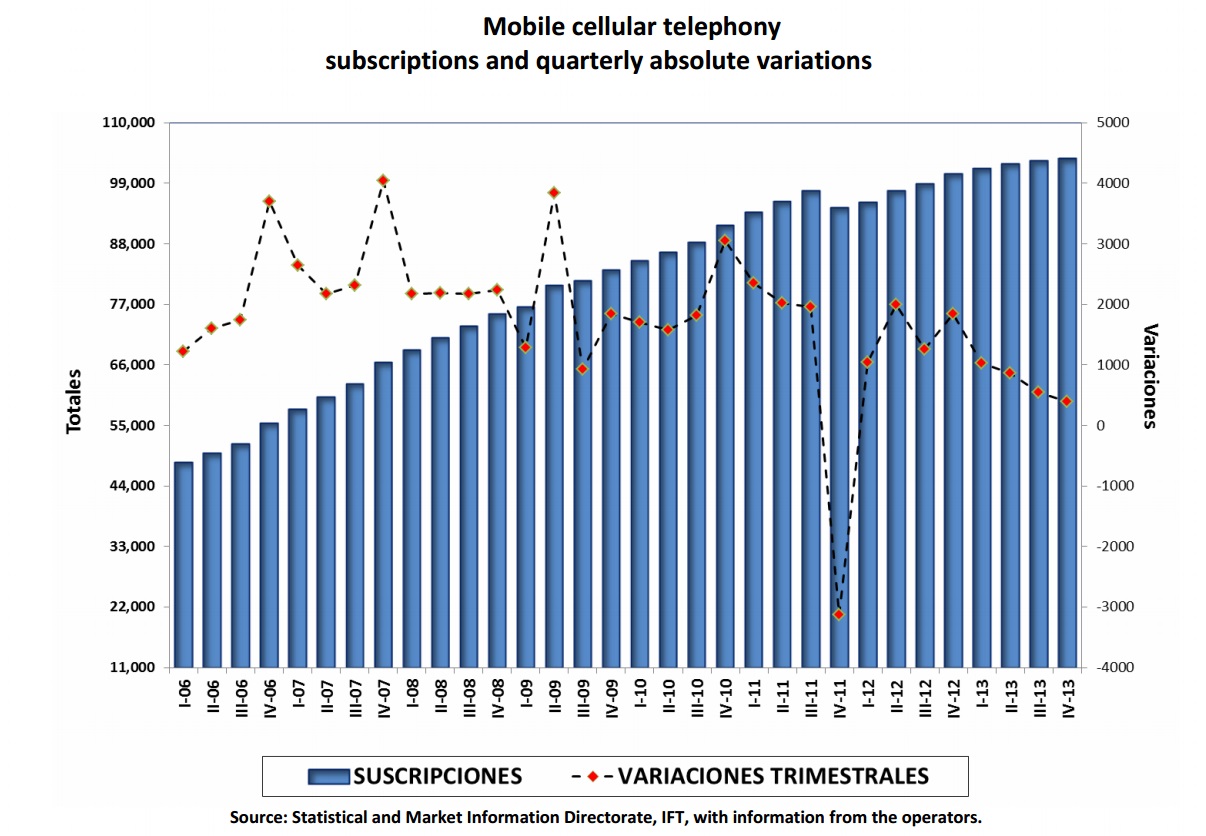

Mobile telephony service registered an increase of 5.6 percent in traffic minutes within the network during the fourth quarter of 2013. From September to December 2013, 393 thousand subscriptions were added, which represent a 3.9 percent increase with respect to the same period the previous year. The base totals 103.6 million subscriptions and represents 87 subscriptions for each 100 inhabitants.

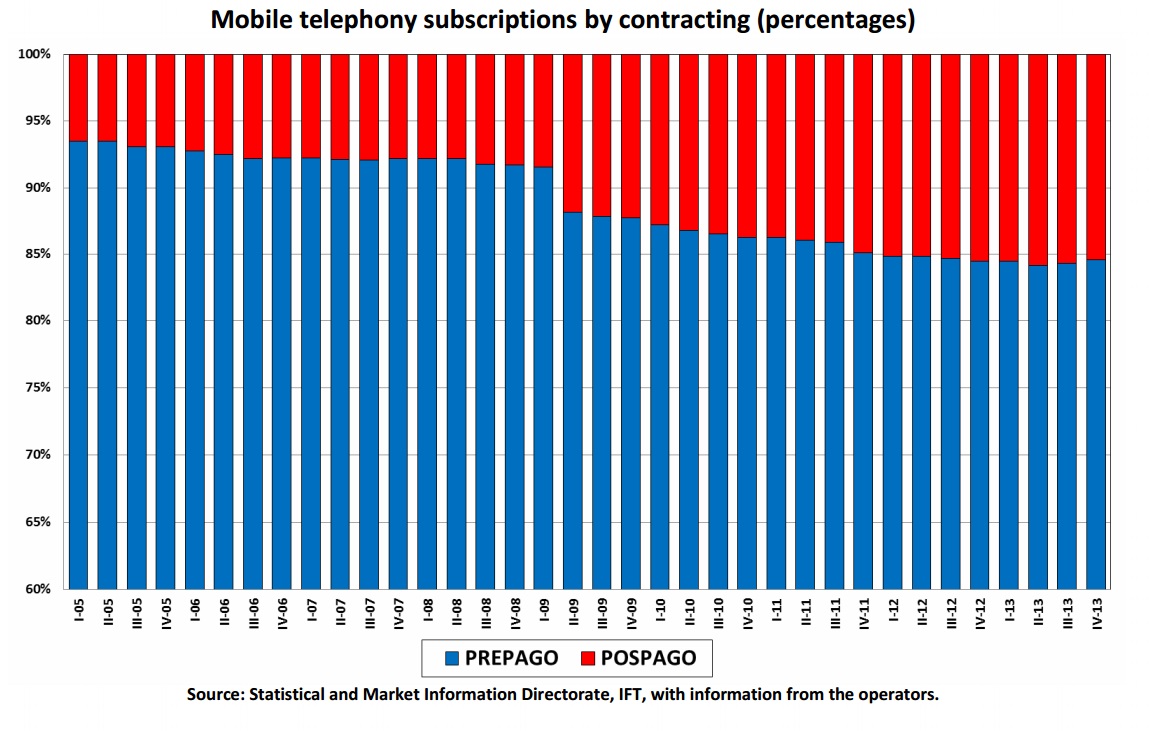

With regard to the composition of the market by type of subscription, at the close of the last quarter of 2013, 16 million post pay users were reported, who represent 15.4 percent of the market total.

Whereas in the prepayment modality, the number closed at 87.6 million subscriptions, which represents a growth of 3 percent with respect to the same period in 2012, and 84.6 percent of the market total.

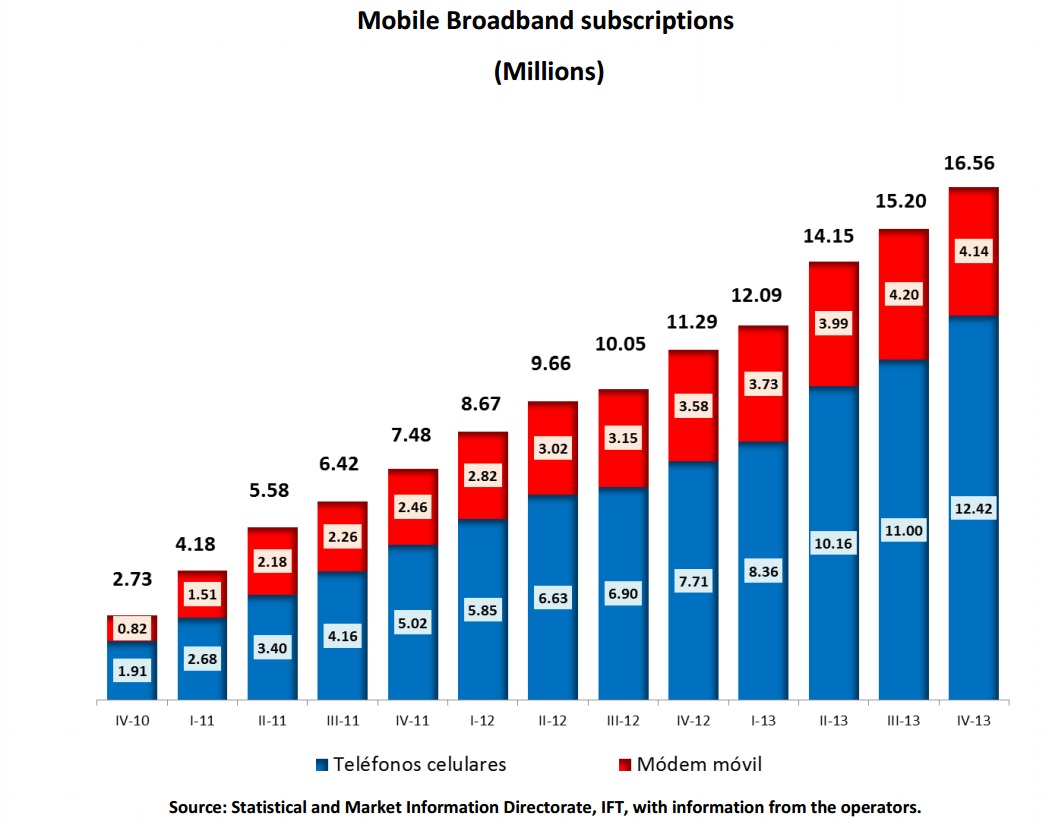

The subscriptions of mobile broadband registered a growth rate of 46.6 percent with respect to the same period in 2012, with which the subscriptions base rose to 16.6 million.

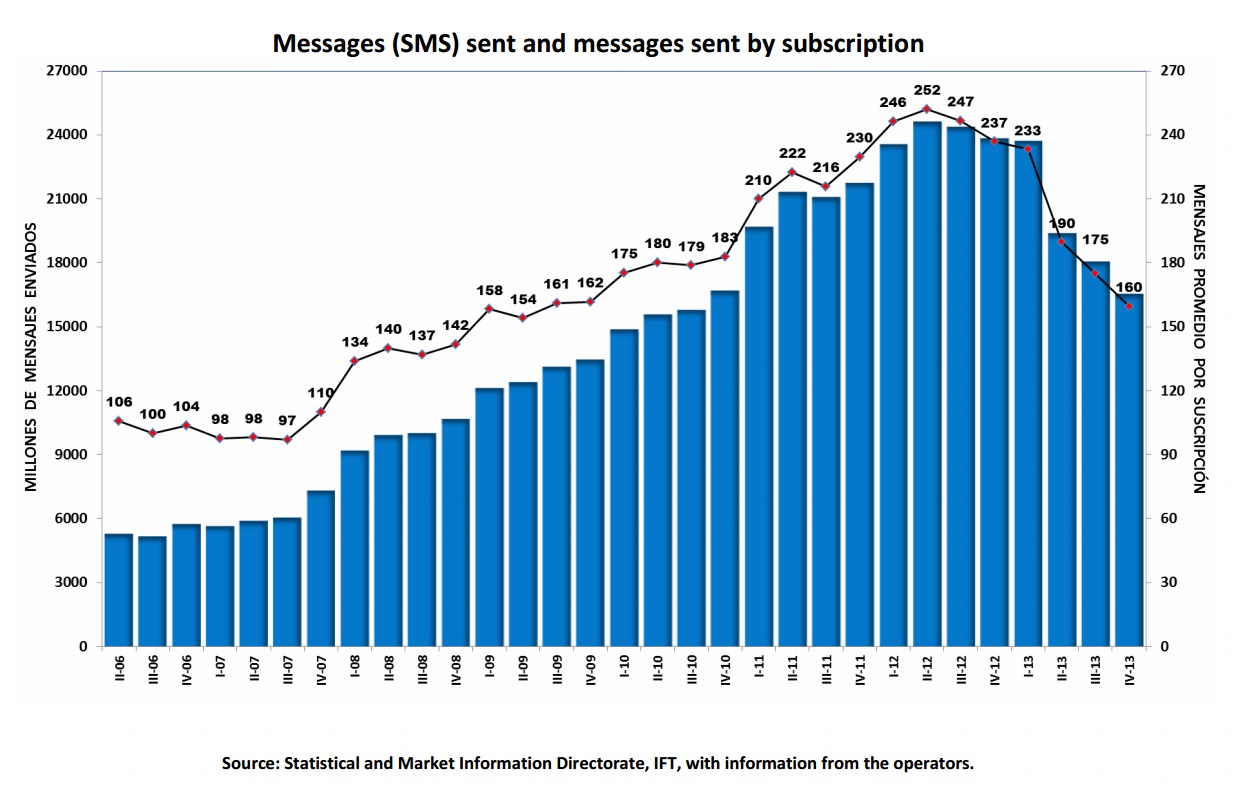

Messages (SMS) sent by mobile cellular telephony networks decreased by 30.6 percent, with respect to the fourth quarter of 2012, which equals an average of 159 messages sent by subscription in the period, the lowest number registered since the second quarter of 2009, with a historical maximum of 252 SMS in the second quarter of 2012.

National long distance

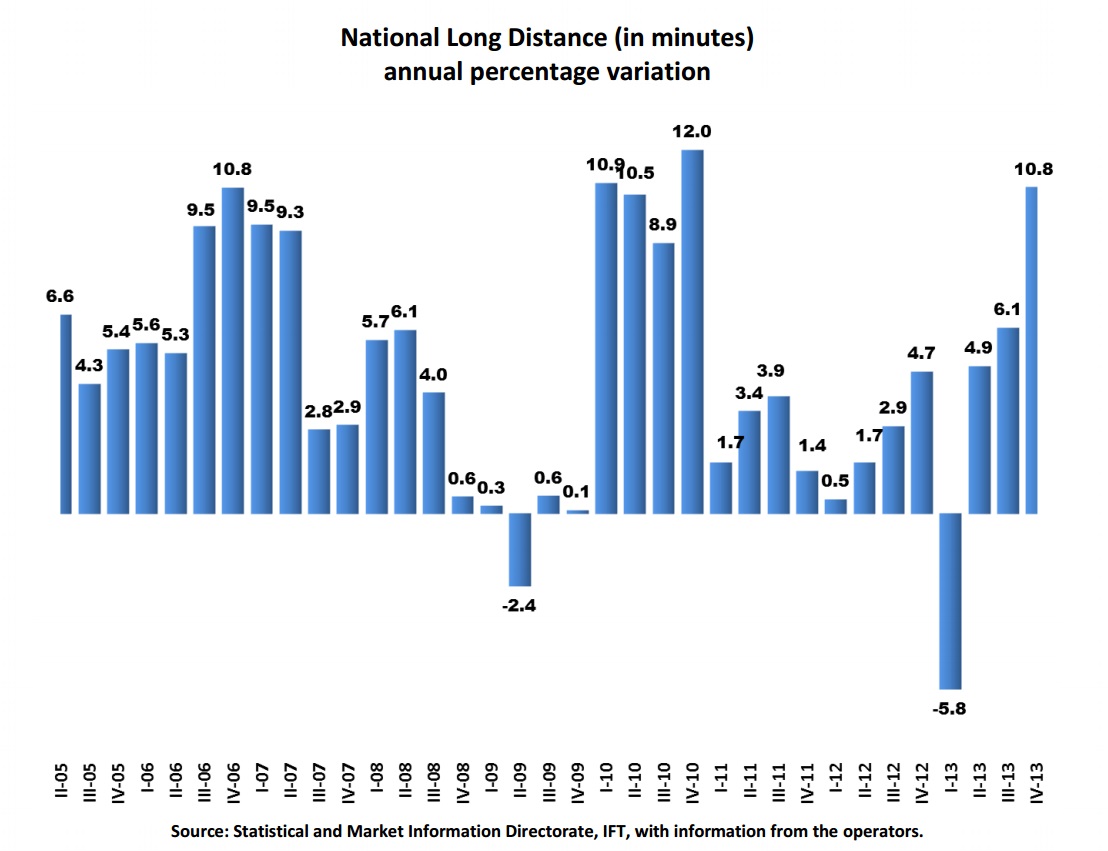

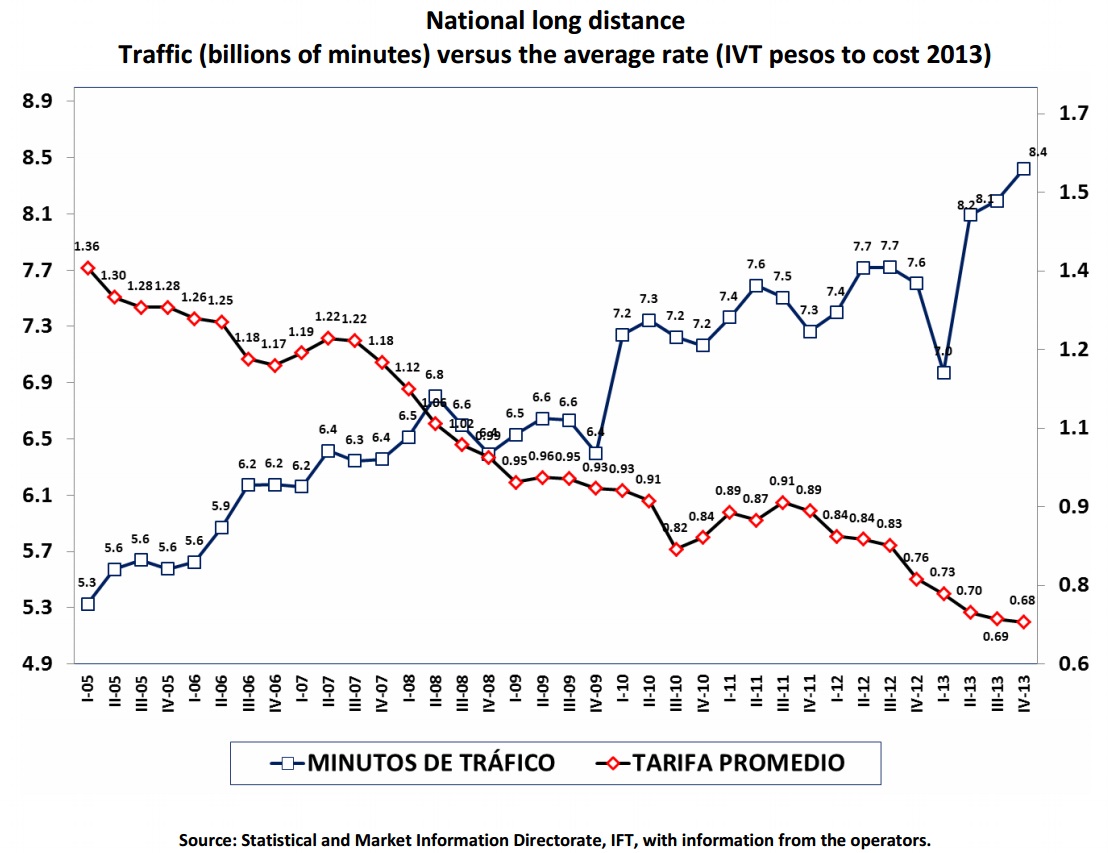

During the reported quarter, the traffic measured in minutes grew 10.8 percent in regards to the same quarter of the previous year.

On its part, the average national long distance rate was 0.68 pesos per minute.

International long distance

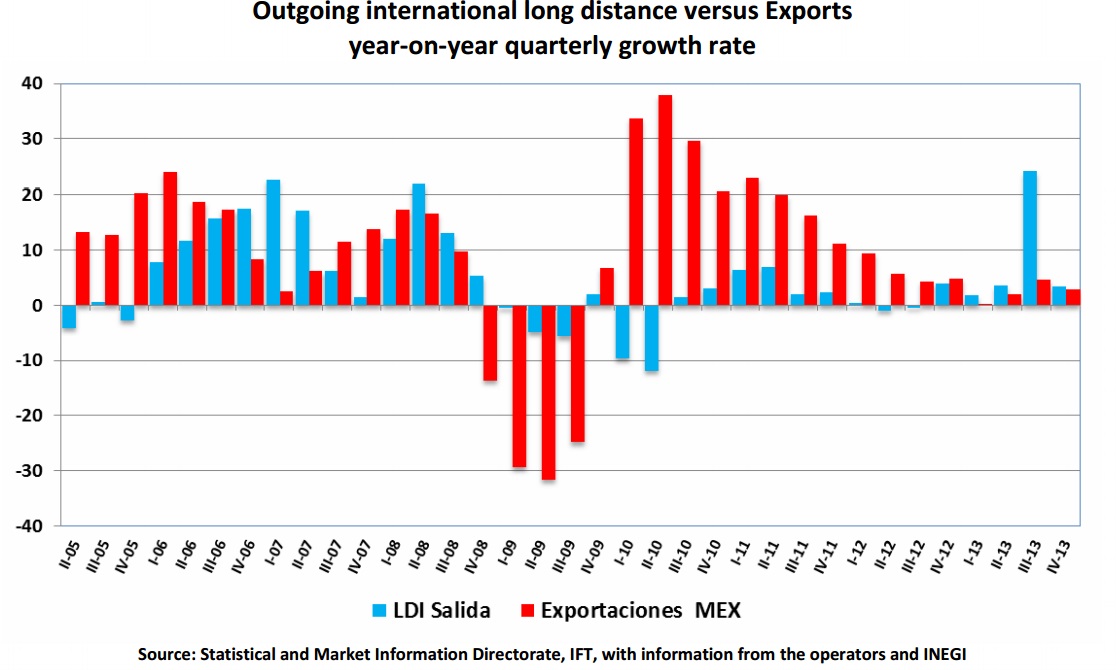

During the quarter, the minutes of traffic of incoming international long distance increased by 27.6 percent with respect to the third quarter of 2012, result of the perspective of greater growth of the American economy.

For its part, the minutes of traffic of outgoing international long distance experienced a growth of 3.5 percent in the reported quarter, compared to the same period of the previous year.

The behavior of international long distance traffic in our country is related to the economic activity of the United States, given the integration of both nations, country with 98.8 percent of the incoming traffic and 88.1 percent of the outgoing traffic.

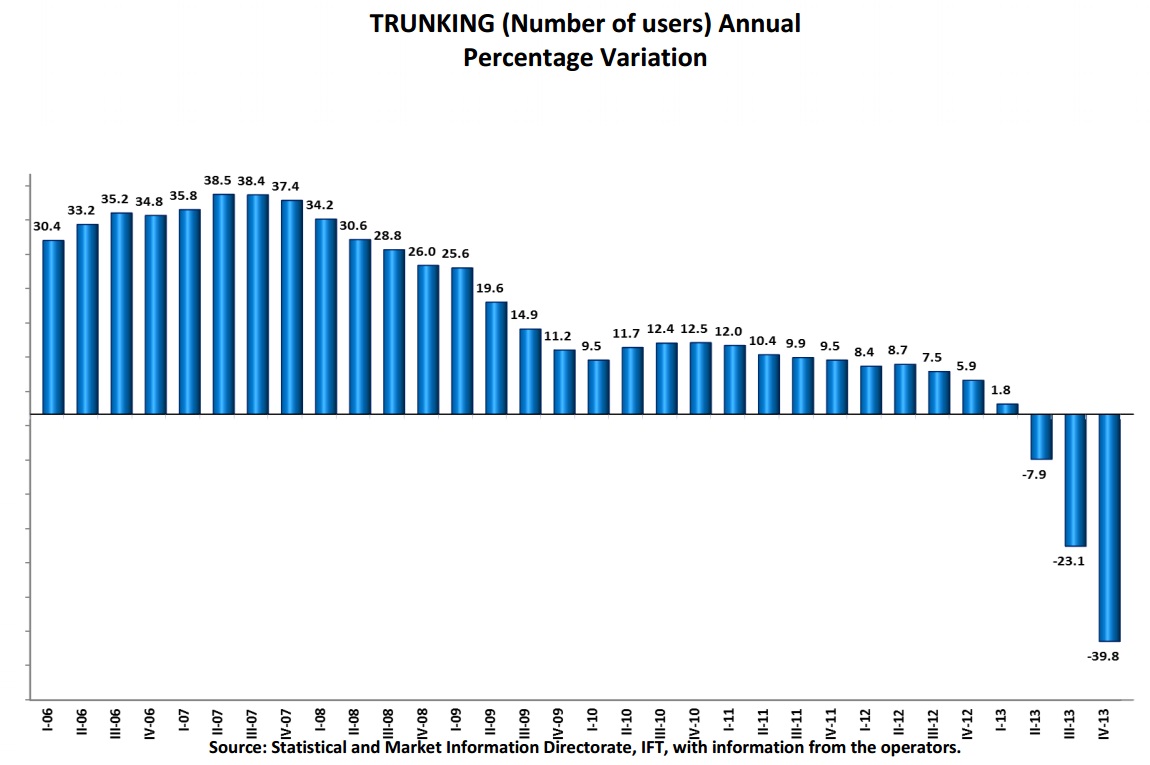

Trunking

During the last quarter of 2013, the number of users in this segment decreased by 39.8 percent with respect to the same period of 2012, which meant the lowest rate reported from the start of measurement of ITEL.

The users of specialized radio communication services (Trunking) are migrating toward state-of-the-art mobile telephony services, with 2.1 million users at the end of 2013.

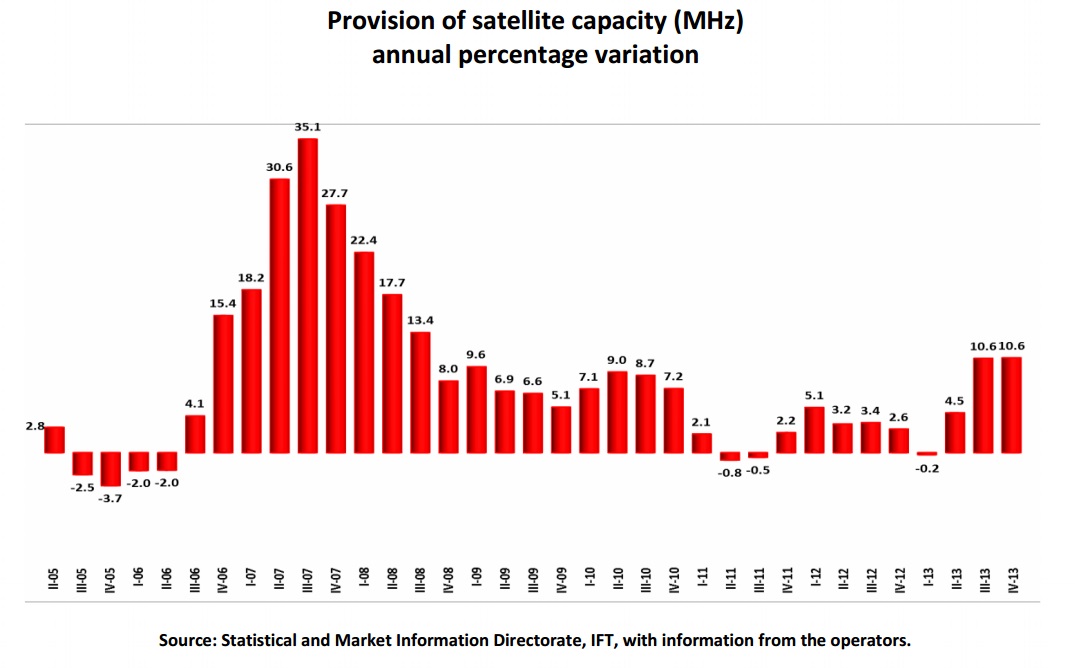

Satellite provision

This segment registered an annual increase of 10.6 percent during the fourth quarter of 2013, equal to the rate reported in the previous quarter. The greater growth of this service can be explained, in part, by the startup of new satellites for public and private services. The unit of measurement for the provision of satellite capacity are Megahertz (MHz).

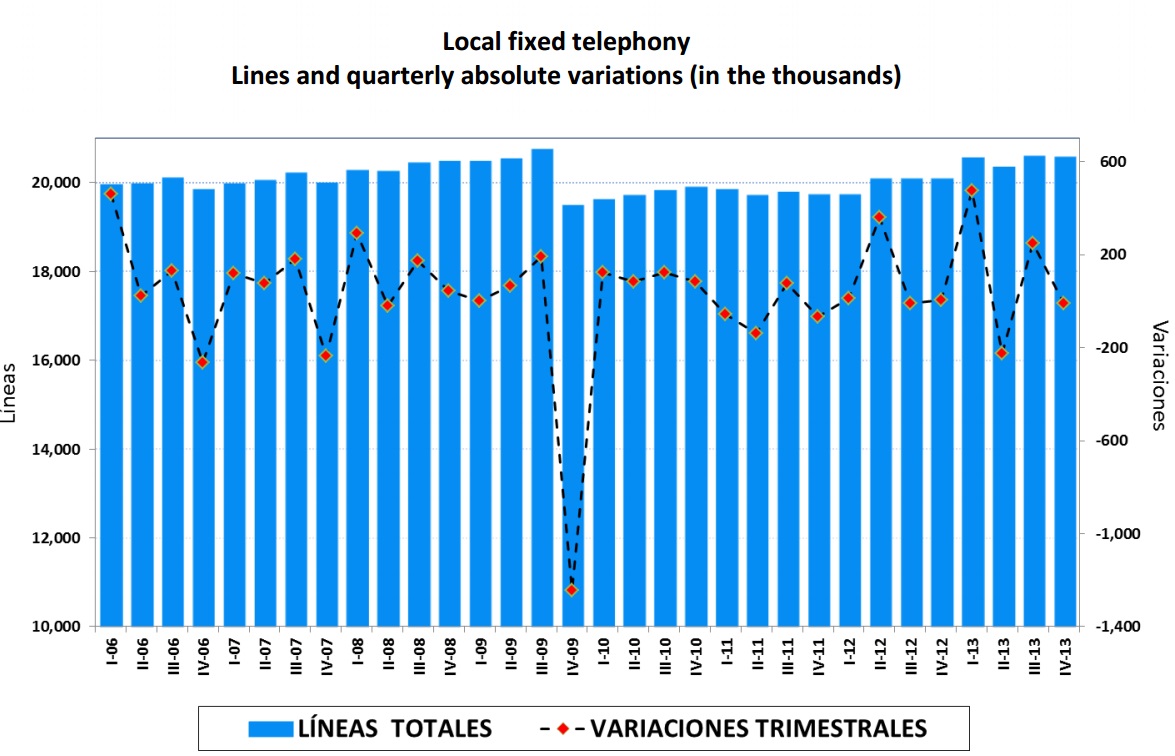

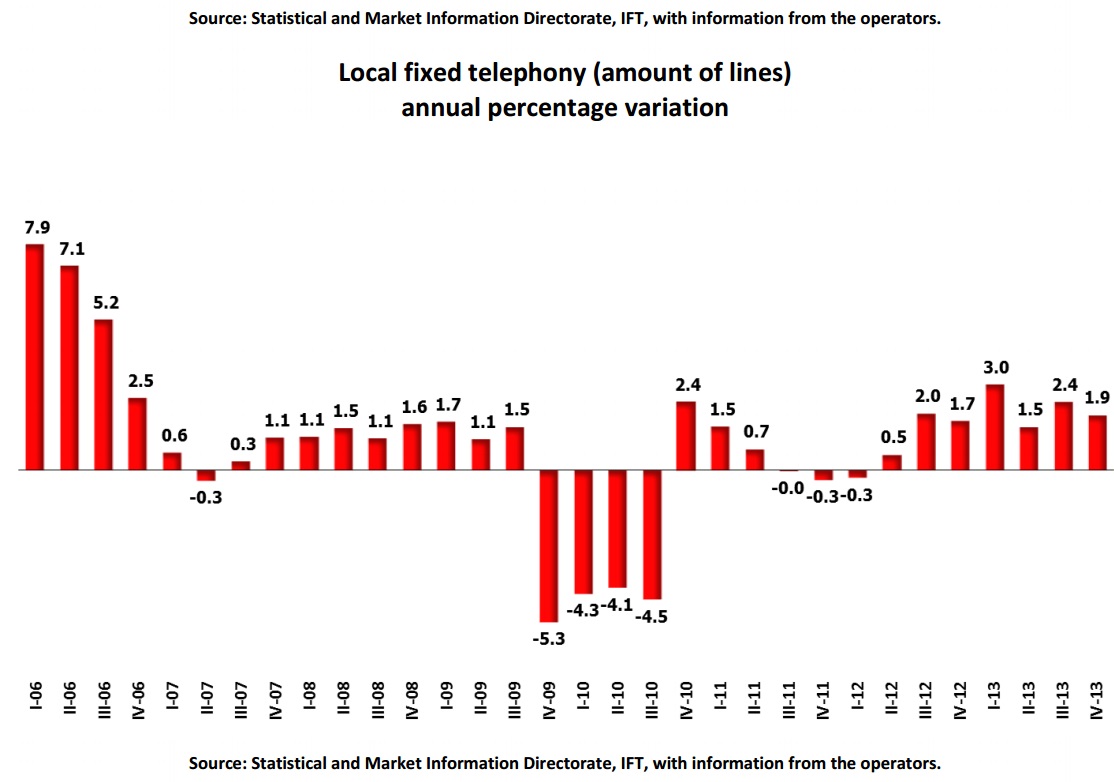

Local fixed telephony

The end of 2013 registered a total number of 20.6 million fixed telephone subscriptions, which represent 490 thousand lines above the same quarter in 2012, and corresponds to a yearly increase of 1.9 percent quarterly in that period. The tendency of this service to rise comes from the alternative suppliers of fixed telephony and from the cable television operators who incorporate the telephony service to their commercial offers. With these modifications in the fixed telephony market, the density of this service in Mexico in the fourth quarter of 2013 was 17.3 fixed telephone subscriptions for each 100 inhabitants.

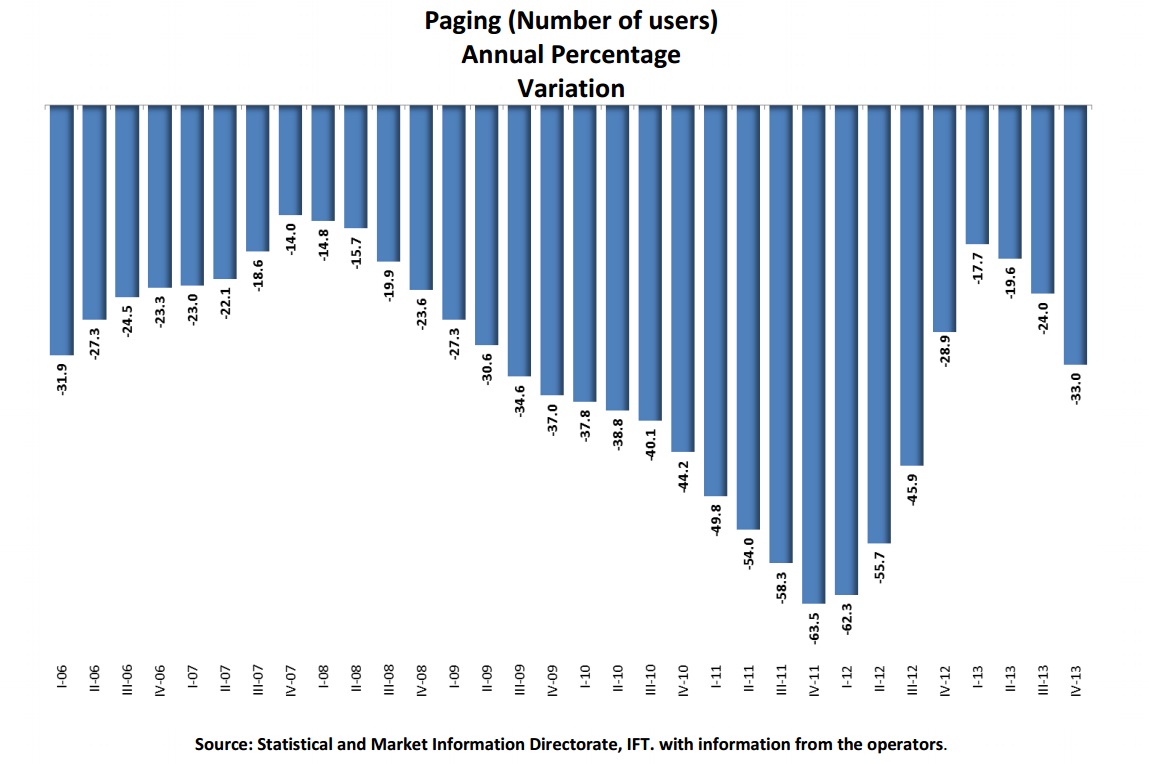

Paging

With regards to the Paging market, the number of users continues with a decreasing tendency; during the last quarter of 2013, the number of users decreased by 33 percent, with respect to the same period in 2012, with 2 thousand 200 users.

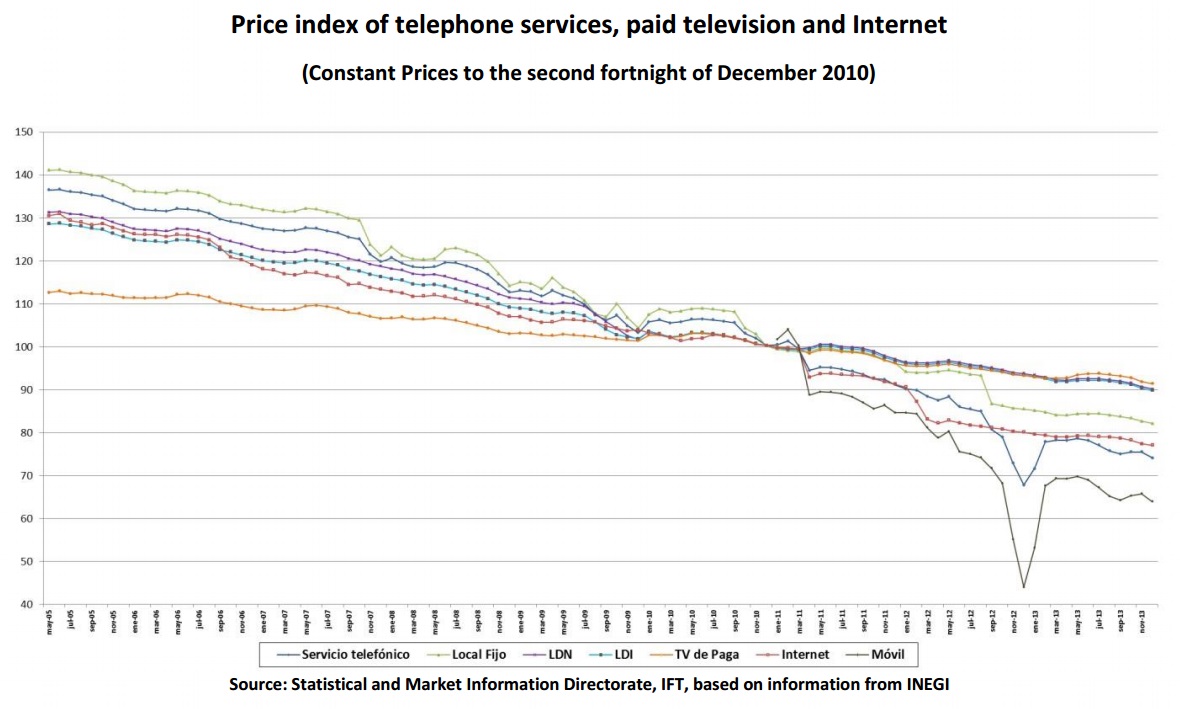

Evolution of rates

The expansion of Internet services, the access to technology at better costs and the competition in the telecommunications market have generated that the concessionaires offer packages and promotions with more attractive rates every time, reason why these present a tendency to lower in nominal and real terms, which has allowed that more and more inhabitants of the country have access to these service

According to information from the National Institute of Informatics, Statistics and Geography (Instituto Nacional de Estadística y Geografía, INEGI), the prices of telecommunications services, measured based on subscripts that compose the National Index of Consumer Prices (Índice Nacional de Precios al Consumidor, INPC), showed important reductions during the fourth quarter of 2013.

This period showed a reduction of the subscript of prices of the telephone service in the order of 9.3 percent, in relation to the same period of 2012, which is composed of a decrease of 4 percent in the local fixed service, reductions of 3.8 percent both in the national long distance service and international long distance service, and contrary in this period, mobile telephony grew 45.1 percent.

As part of the subscript of other services calculated by the INEGI, reductions in real terms of 2.1 and 3.8 percent in the services of paid television and Internet are observed, respectively, compared to the same period in 2012.

It is important to mention that the measurements of telecommunications services prices made by the INEGI are within the objectives of the INPC, that is to measure the evolution in time of the general level of prices of the goods and services that urban homes of the country consume; in this sense, its representativeness is focused on a basket of goods and services that reflect the consumption patterns in homes2[2].

Final considerations

During the trimester of reference, it is observed that the tendency continues toward a moderate growth of fixed voice telephony services; which has been compensated mainly by the advance in the subscriptions of the broadband services that the fixed telephony companies can provide on their same telecommunications infrastructure.

The service of continuous mobile broadband, being one of the pillars of the growth of the telecommunications sector, growing at two digit rates in subscriptions, stimulated to a great extent by the reductions of rates and the development of applications for state-of-the-art mobile devices.

The restricted television market acquired a new dynamic from which the competition between operators and the new consumption patterns of the users who demand an ampler range of rate plans, accessibility and lower prices.

It is expected that during the following quarters, the tendency of growth of this industry is maintained, supported, partly, by the expectation of growth of the Mexican economy, from 3,4 percent for this year to 3.9 percent for 2015, and the expectations regarding the American economy, which expects a growth of 2.73 and 2.99 percent for 2014 and 2015, respectively.[3]

NOTE: The results in the present document come from data and estimations to the year 2013.

[1] An explanation of the methodology used for the calculation of the ITEL can be seen at:

https://www.ift.org.mx/iftweb/wp-content/uploads/2012/09/ITEL_Nota-Metodologica_2010.pdf

[2] A more comprehensive explanation can be found in methodological documents of INEGI, which can be consulted at: http://www.inegi.org.mx/est/contenidos/proyectos/inp/Default.aspx.

[3] Source: Bank of Mexico: Survey on the expectations of the specialists in economy of the private sector: January, 2014.